Cañariaco Norte

A Large Scale Copper Project in Peru

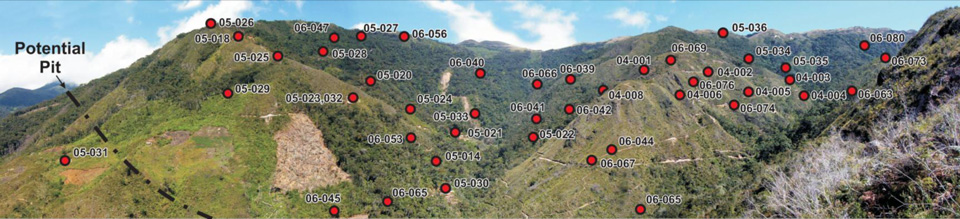

A portion of the Cañariaco Norte Copper Deposit with selected drill holes collars superimposed.

Since 2004, Alta Copper has drilled more than 85,000m in 289 drill holes at Cañariaco Norte to define a 9.3B pounds Measured and Indicated Resource, plus 2.7B pounds Inferred Porphyry Copper Deposit, with excellent expansion potential through, Cañariaco Sur, which has an initial Inferred Resource of 2.2B pounds of copper, 1.2M ounces of gold and 15.0M ounces of silver and the Quebrada Verde target. Cañariaco Norte also contains a Measured and Indicated Resource of 2.14M ounces of gold and 59.43M ounces of silver plus an additional Inferred Resource of 0.54M ounces of gold and 18.09M ounces of silver.

(see in details Resource Tables below)

2024 PEA - Summary of Economic Results

|

AFTER-TAX (US$M, Unless Otherwise Stated) |

|||||||||

|---|---|---|---|---|---|---|---|---|---|

|

Cu Price (US$/lb) |

3.50 |

3.85 |

4.00 |

4.50 |

5.00 |

||||

|

Undiscounted After-Tax Cash Flow (LOM) |

|

5,887 |

7,572 |

8,293 |

10,677 |

13,055 |

|||

|

Net Present Value (8%) |

|

1,450 |

2,054 |

2,312 |

3,163 |

4,011 |

|||

|

IRR (%) |

|

18.7 |

22.5 |

24.1 |

28.9 |

33.4 |

|||

|

Average Annual Revenue (US$M) |

|

1,118 |

1,217 |

1,259 |

1,401 |

1,542 |

|||

|

Average Annual EBITA |

|

463 |

561 |

604 |

744 |

885 |

|||

|

Average Annual Free Cash Flow (Note 3) |

|

295 |

356 |

383 |

470 |

557 |

|||

|

Average Annual Free Cash Flow (Year 1-10) (Note 3) |

|

437 |

508 |

538 |

638 |

739 |

|||

|

Payback Period (Note 3) |

|

3.7 |

3.2 |

3.1 |

2.6 |

2.3 |

|||

|

PRE-TAX (US$M, Unless Otherwise Stated) |

|||||||||

|

Undiscounted Pre-Tax Cash Flow (LOM) |

|

9,746 |

12,433 |

13,585 |

17,424 |

21,264 |

|||

|

Net Present Value (8%) |

|

2,735 |

3,701 |

4,115 |

5,496 |

6,876 |

|||

|

IRR (%) |

|

25.3 |

30.3 |

32.4 |

39.0 |

45.1 |

|||

|

Mill Throughput |

120,000 tpd |

||||||||

|

Average Annual Cu Production (Year 1 to 10) |

347 million lbs Cu | 158K tonne Cu |

||||||||

|

Average Annual Cu Production (LOM) |

294 million lbs Cu | 134K tonne Cu |

||||||||

|

C-1 Cash Costs (net of by-products) $/lb |

1.86 |

||||||||

|

AISC (Note 5) $/lb |

1.96 |

||||||||

|

Strip Ratio (Waste to Ore) |

1.33 to 1 |

||||||||

|

Initial Mine Life (Years) |

27 |

||||||||

|

Initial Project Capital |

2,160 |

||||||||

|

Sustaining Capital |

526 |

||||||||

|

Closure Cost |

216 |

||||||||

Notes

(1) Copper contributes 88% of the net revenue with the balance of 12% from gold silver credits in copper concentrate.

(2) For this analysis Gold is US$1,850/oz and Sliver is US$23/oz and remain constant with only the Copper price changing.

(3) From Commencement of Operations.

(4) Cash Costs consist of mining, processing, site G&A, off-site treatment and refining, transport, and royalties net of by-product

credits (Au & Ag).

(5) AISC consists of Cash Costs plus sustaining capital and closure costs.

Cañariaco Norte Mineral Resource Estimate (0.15% Copper Cut-off Grade)

| Contained Metal | ||||||||

| Resource Classification |

tonnes (Mt) |

Cu Eq (%) | Cu (%) | Au (g/t) |

Ag (g/t) |

Copper (B lbs) |

Gold (M Ozs) |

Silver (M Ozs) |

| Measured | 423.5 | 0.48 | 0.43 | 0.07 | 1.9 | 4.04 | 0.98 | 25.71 |

| Indicated | 670.7 | 0.39 | 0.36 | 0.05 | 1.6 | 5.25 | 1.16 | 33.72 |

| Measured+ Indicated | 1,094.2 | 0.42 | 0.39 | 0.06 | 1.7 | 9.29 | 2.14 | 59.43 |

| Inferred | 410.6 | 0.32 | 0.29 | 0.04 | 1.4 | 2.66 | 0.55 | 18.09 |

Location Map